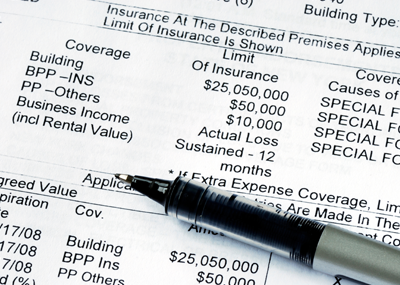

While some insurance defense firms handle coverage issues as a part of their overall defense practice, we consider coverage opinions and reservation of rights to be a special category of their own that require an experienced coverage attorney. Roberts Perryman has decades of experience in interpreting insurance policies of all types. We have litigated and tried many cases and resolved hundreds more through dispositive motions and alternative dispute resolution, such as mediation and arbitration.

We have been successful in coverage disputes involving, but not limited to commercial general liability, auto, cyber, property, freight-broker, uninsured and underinsured motorist coverage, permissive use, pollution exclusion, professional liability, and construction defect.

Our firm is experienced in analyzing and providing coverage opinions on all types of policies including:

- General Liability

- Claims Made

- Excess and Reinsurance

- Auto

- Homeowner’s

- Life

- Professional Liability

- E & O

- Surplus Lines

- Cyber

- Freight Broker & Contingent Auto

The issues we have counseled our insurance clients on include:

- Cyber

- Professional Liability/E&O

- Products

- Construction Defect

- Auto/Trucking

- Pollution Exclusions

- Assault & Battery Exclusions

- Toxic Torts and Long Tail Claims

- Trigger

- Allocation

- Other insurance/Priority of Coverage Issues

- First Party Coverage

- Arson/Fraud

- Duty to Defend/Indemnify

- Employment/Workers’ Compensation

- Insurance Agent and Broker Liability

- Bad Faith and Vexatious Refusal Claims

- Section 537.065 Agreements

- Extra-Contractual Liability

- Reservation of Rights/Denial Letters

When it comes to coverage matters, we have found that only a few firms are equipped to provide the answers you need immediately. At Roberts Perryman we can answer your coverage questions, render a coverage opinion, draft a reservation of rights letter, prosecute a declaratory action, assess indemnity obligations, and advise on the steps to protect insurers from extra-contractual liability and the pitfalls of Missouri’s infamous Section 537.065.